Key takeaways An emergency fund helps ensure you can handle unplanned expenses, whether from a job loss or a substantial car repair or medical bill. Saving three to six months’ worth of essential expenses is often recommended, but individual circumstances may require saving more or less. Automating savings and using…

VIEW press/Contributor/Getty Images Wells Fargo is a financial institution that offers its customers personal, small business, commercial, corporate and investment banking solutions. There are currently around 5,600 branches and 11,000 ATMs nationwide. Wells Fargo Bank near me You can find a Wells Fargo retail banking branch near you by using…

Key takeaways Mobile banking alerts detect fraud faster than manual monitoring. The sooner you report unauthorized activity, the greater your chance of full reimbursement under federal law. Low balance alerts help you avoid overdraft fees, which average $26.77 per transaction in 2025, according to Bankrate’s checking account survey. Essential alerts…

You’ve heard of home equity lines of credit (HELOCs) and home equity loans, which let you borrow against the value of your home, getting ready cash for renovations, debt consolidation or anything else. But jumping through the income-qualification hoops that characterize much home-based financing may be difficult for borrowers with…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

Key takeaways A bank statement loan allows you to qualify for a mortgage using bank statements rather than pay stubs or tax returns. It’s most often used by self-employed borrowers. Not all mortgage lenders offer bank statement loans. You might need to work with a…

Dept Managmnt

2. Coaching and Tutoring Take stock of your areas of expertise – maybe you speak a second language or solving math equations comes…

Banking

These entrepreneurs, traders and investors are making an outsized impact in fintech, crypto and traditional financial services.By Jeff Kauflin, Hank Tucker and Nina…

Credit Cards

All News

Whether you can claim an adult child as a dependent on your taxes depends on their age, income and living situation, as well as the level of financial support you provide to them. The IRS allows parents to claim certain adult children if they meet the criteria for either a…

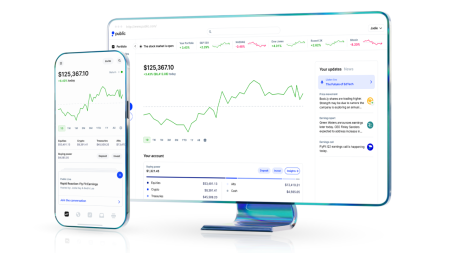

Public is an investing platform that offers a solid trading experience, free trades on stocks and ETFs, easy access to bonds — and options traders will enjoy getting money back on their trades through Public’s rebate program. Other key features include: Fractional shares, so you can trade with as little…

A nursing home cannot directly seize funds held in an individual retirement account (IRA). However, retirement accounts in many states are generally treated as countable assets for Medicaid eligibility, which means their value can affect whether you qualify for Medicaid coverage of long-term care. In many cases, this requires a…

Capital gains are the profit you earn when you sell an asset like a home, business or stocks. Those gains are subject to capital-gains taxes, but capital gains are taxed differently depending on the type of asset — and how long you owned the asset. That’s because, while the federal…

Key takeaways The first step to saving is setting specific, achievable goals and tracking your progress using a digital budgeting tool, spreadsheet or pen and paper. Following a budget can help you identify ways you can add to savings as well as pay down debt. Ways to help you save…

“I’m standing there watching my house burn, and I’m like, oh my goodness, this is everything that I worked for.” When Rahkim Sabree, AFC followed a gut feeling to return home early from an outing in October, he didn’t expect to find his living room engulfed in flames. “It’s when…

Key takeaways Using extra cash to pay off your mortgage loan early can save homeowners a hefty amount of interest over time. However, putting available funds into investments instead might yield a more significant return and make you more money. The answer to which is right for you will depend…

staticnak1983/Getty Images Key takeaways Short-term CDs typically are those that mature within one year, while long-term CDs have terms ranging from three to five years. Currently, some top-earning long-term CDs have slightly higher interest rates than short-term ones. You can use a CD ladder to take advantage of the benefits…

Key takeaways A good credit card APR is a rate that’s at or below the national average, which currently sits just below 20%. While there are credit cards with APRs below 10%, they’re most often found at credit unions or small local banks. If you don’t have good credit, you’re…

If you’re looking to buy a home, choosing the right mortgage lender can save you money. That’s especially true if you’re planning on taking out a larger jumbo loan. To help you in your search, here is our guide to the best jumbo mortgage lenders in 2026. Best mortgage lenders…